Last week, I wrote about last will and testament and revocable living trust (RLT). I received a few inquiries and questions about RLT from friends and relatives. Since I am not an expert on the subject, I promise I do some Internet search and post it here in my blog. Here's an excellent article by Newland & Associates titled Plain English Explanation of Revocable Living Trusts and Pour-over Wills. Enjoy!

"It has been humorously noted that an oral contract is not worth the paper it is written on. An oral Trust, though possible, would not be worth very much either, since it would be nearly impossible for your Successor Trustees (the ones who succeed you) to implement the Trust at some future date based on oral guidance. Trusts also need to be in writing because they are designed to cover many contingencies (such as incapacity and death) in both the near and distant future. In order to provide for these contingencies and assure an orderly succession of Trustees (among other things), there is a lot of verbiage in the typical Trust which some find unduly lengthy or technical. This Plain-English explanation is intended to outline, in a simplified fashion, what these legal documents are intended to do.

There are three essential players in every Trust:the Grantor (Creator)

the "do-er" (the Trustee who has duties to perform); and

the Beneficiary (the one who receives benefits from the Trust).

Of course, there can be more than one trustee or beneficiary in any Trust.

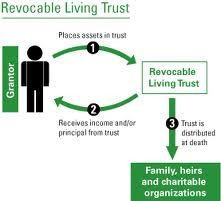

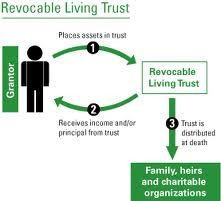

At the beginning of most Revocable Living Trusts, the Grantor (who creates the Trust) usually plays all three roles -- Grantor, Trustee, and Beneficiary. When the Grantor becomes incapacitated or dies, the Successor Trustees take over for the Grantor and, of course, the initial Beneficiary (the Grantor) must change if the Grantor is deceased.

It Isn't Chiseled in StoneA Revocable Living Trust is referred to as "revocable" because, as the name implies, it can be revoked in whole or in part during the creator's ("Grantor's") life. Of course, the beneficiaries can be changed during the Grantor's life, although few Grantors make such changes. The term "living" means the Trust was created during the life of the Grantor, as opposed to "at death," as happens with Trust provisions in a Will, which is called a Testamentary Trust. While the Trust does become irrevocable (unchangeable) at the death of the Grantor, there are usually broad grants of power given to the Successor Trustees (the ones who take over after the Grantor's death) to make discretionary distributions to family members for a variety of purposes.

Most Revocable Living Trusts provide estate tax relief for married couples and keep the family wealth in a form (the Trust) that allows adult children (as Trustees) or a Trust company to provide assistance for the surviving spouse. One of the key features of these Trusts is the ability to obtain estate tax savings for married couples while, at the same time, keeping the financial benefits of all of the family wealth available to the surviving spouse (and children) for health, support, maintenance, and education. This can be done without having everything taxed again when the second spouse dies. To use an over-repeated phrase, the use of Trusts in this manner is like "having your cake and eating it too."

Lack of MaturityWhile many of us wonder if we have truly obtained maturity, we readily agree that often our children and grandchildren are suspect when it comes to handling large sums of money. Many Trusts contain built-in flexibility that allows the Trust to continue until children or grandchildren reach a designated age, say 25, when they may be more mature than an 18-year-old.

Income taxDuring the Grantor's life, this Trust does not reduce income tax (as opposed to estate tax). The income from assets placed in the Trust is reported on your income tax return in the same manner as before you placed the assets in the Trust.

The following sections refer to, and give brief explanations of the purpose and function of, the major parts of the Trust.

Article I: Successor TrusteesThe purpose of this section is to provide for someone ("the Successor Trustees") to take over in the event of the death or incapacity of the Grantor. The Grantor, of course, has the right to remove the Successor Trustees, and the Trustees have the right to resign. Should a Trustee resign without a replacement being designated by the Trust, there is a mechanism for picking a successor Trustees.

Article I concludes with directions about the responsibilities of the Successor Trustees. This Article says that the successors are responsible for what they get from the Trust when they take over and that they are required to submit annual reports between the time of the death of the Grantor and the termination of the Trust.

Article II: Transfer of Property and BeneficiariesThe purpose of Article II is to describe how assets may be transferred to the Trust and listed on Schedule A. Assets such as land, stock, saving certificates, securities, and items of that nature are evidenced by "documents of title" (e.g. deeds), and you need to have new "documents of title" prepared so the Trust is recorded as the owner of such assets so as to avoid probate of them at your death. Schedule A is intended to serve both as a convenient mechanism for keeping track of what has been transferred to the Trust and as a way of establishing the Trust's ownership of properties that do not have "documents of title."

Thus, property, such as land, even if it is not shown on Schedule A, can still be part of the Trust if a new deed reflecting the Trust as owner has been completed. Similarly, for items that do not have "documents of title," such as jewelry collections, coin collections, antiques, etc., the only evidence of ownership by the Trust may be listing them on Schedule A. The Grantor can, of course, take assets out of the Trust and add assets. Assets not included in the Trust may be subject to probate if not jointly owned with a spouse or others.

In Trusts prepared by Newland & Associates, there will usually be a list of beneficiaries. The purpose of the list of beneficiaries is to show the immediate family the beneficiaries and their ages so that the Successor Trustee(s), particularly if it is a bank or trust company, will be aware of their existence. If one of the immediate beneficiaries, such as a son or daughter, should predecease one or both spouses, it is possible in many Trusts for grandchildren or other contingent beneficiaries to become beneficiaries of Trust property.

Article III: Rights Reserved by Grantor (Creator)Because this is a "Revocable" Trust, the Grantor has the right to change or alter the Trust, terminate it, and withdraw all of the assets.

Article IV: Insurance ProvisionsThe purpose of Article IV is to allow insurance proceeds to be paid to the Trust in order that the Trust objectives can actually be paid. Usually, the life insurance premiums are paid by the Grantor, and the ownership of the policy stays with the Grantor.

This Article includes wording concerning "pledging policies," in case there is need to borrow against a policy. On such an occasion, an insurance company will ask that the Successor Trustees also be obligated to repay the loan.

At the conclusion of Article IV, there is a section entitled "Collecting Policy Proceeds." While it may be seldom used, this provision allows the Successor Trustees to institute a legal action against an insurance company if it refuses to pay the policy proceeds to the Trust.

Article V: Lifetime DistributionsSince this is a "Revocable" Trust, all of the income earned by the Trust is reported on the Grantor's individual (or joint) income tax return, Form 1040, while he or she is alive. There is no need to file a separate tax return for Trust income until after the death of the Grantor. Article V provides for the distribution of all income and principal to the Grantor during life.

IncapacityUpon the incapacity of the Grantor, the Successor Trustees will take over and distribute income to the Grantor (and those dependent upon the Grantor) consistent with their style of living and the assets of the Trust.

Life Support Systems (Health-Care Directive)

In the event the Grantor becomes terminally ill or irreversibly comatose and is receiving life-prolonging medical treatment, the health-care provider (physician or hospital staff members) shall consult with the Successor Trustees to determine if such measures should be continued. This wording is not designed to be a "living will" ( a better title is "Health-Care Directive") but rather to serve as supplemental guidance, expressing the intent of the Grantor to the Successor Trustees and those providing medical assistance.

Article VI: Distributions at Death of GrantorWhat happens when the Grantor dies? Article VI addresses that situation. In some Trusts, there may be cash gifts or bequests at the death of the Grantor. Such cash gifts are usually mentioned in the beginning of Article VI. After the cash bequests, if any, the Trust is usually divided into two parts referred to as the "Marital Trust" and the "Family Trust," if there is likely to be a surviving spouse.

Even though the Trust assets are not subject to probate, they are subject to estate taxes. The purpose of the "Marital Trust" is to claim as a "marital deduction" against estate taxes exactly the amount which will reduce the estate tax on the Trust to zero. Hence, the term "Reduce to Zero Formula." In essence, the "Marital Trust" will be exempt from estate tax at the Grantor's death, but the "Family Trust" will be subject to estate taxes. Since, however, the size of the "Family Trust" will equal the amount of the available estate tax exemption, there will be no tax due on the Family Trust at the death of the Grantor. The Marital Trust will be subject to estate tax when the surviving spouse dies.

For example, in 1997, in estates which would have exceeded the lifetime exempt amount of $600,000, the amount of marital deduction claimed would have been the amount needed to reduce the size Family Trust to $600,000. Thus, in 1997, if the value of the assets in the estate were $800,000, then the marital deduction would have been $200,000, leaving $600,000 in the Family Trust.

Marital TrustThe "Reduced to Zero Formula" appears near the beginning of the Marital Trust portion. While the operation of the formula is difficult for some to understand, the objective of it is rather simple -- to eliminate estate tax at the death of the first spouse. You may notice that no dollar amount is mentioned in the Trust, nor is the estate tax credit itself mentioned. The reason for this is that Congress is changing the size of the lifetime exemption.

For a number of years prior to 1997, it was $600,000. For estates beginning after 1997, the amount of the lifetime exemption or exclusion will be different almost every year. Under tax legislation enacted in 1997, beginning in 1998 and running through 2007, the amount of the exemption will rise in a number of steps from $625,000 to $1,000,000. After 2007, the amount of the lifetime exclusion will be adjusted every year for inflation. In other words, it is impossible to predict what the exact exemption amount will be when this provision of the Trust comes into effect. Even though the specific value of the lifetime exemption will change, the formula will automatically adjust the size of the Family Trust to match the lifetime exemption amount then in effect. It will usually not be necessary to amend the Trust. Trusts written over 15 years ago are still quite workable today using this word formula despite changes in the lifetime exemption during that period.

Jointly owned Property -- If property is jointly held and is not titled to the Trust (as sometimes happens when property is purchased after the Trust is adopted), this jointly held property needs to be factored into the "reduce to zero formula."

There can be complications with regard to which types of assets may be allocated to the Marital Trust, for example whether such assets are subject to foreign tax, etc. This section of the Trust contains technical language that is mind-numbingly complex for most people but is required because of the Internal Revenue Code, Regulations, and case law.

In order to avoid estate tax at the first death, the provisions of the Marital Trust must satisfy a number of requirements. One of these is that all of the income from the assets allocated to the Marital Trust must be distributed to the surviving spouse at least quarterly. It is possible to restrict the distribution of principal (as opposed to income) from the Marital Trust. However, in many Trusts created by Newland & Associates, the surviving spouse has the right to withdraw principal amounts from the Marital Trust for any purpose which he or she deems necessary.

At the conclusion of the Marital Trust is wording relating to the Will of the surviving spouse. The Will of the surviving spouse may dispose of the assets in the Marital Trust. If the surviving spouse has no Will or the Will has been revoked, the surviving spouse's marital portion would eventually "pour-over" to the Family Trust.

While simultaneous deaths are very rare, many Trusts and Wills have wording in them to provide that should there be a simultaneous death, a certain spouse is deemed to have "survived." While all of this sounds hyper-technical, in some cases it is important that the order of death be specified in order to obtain certain beneficial estate tax results.

Family TrustIn smaller estates, the Family Trust usually does not exceed the amount that one person can transfer without incurring estate tax. In 1997 that amount, the so-called lifetime exemption, was $600,000. In accordance with 1997 legislation, the lifetime exemption increases over the years. The assets in the Family Trust, of course, can be less than the amount of the lifetime exemption, if at the time of death that is all the Grantor has contributed to the Trust and no more is received after probate (if any) of the Grantor's estate.

One of the nice things about the Family Trust, in particular, is that it allows for a "sprinkling" (some use the term "spraying") of income and principal to those family members who need it most. Of course, it is up to the Grantor to decide whether or not to select "sprinkling" provisions. Most do. Alternatively, it is permissible for all of the income and principal to go to the surviving spouse or one particular person, such as a child. However, it is probably better to allow for the "sprinkling" of income and principal.

The surviving spouse generally has access (directly or indirectly) to all of the assets, subject to the restriction that the distribution of principal from the Family Trust must be limited by four magic words -- "health," support," "maintenance," and "education." These four magic words have been interpreted by IRS Regulations and case law as an "ascertainable standard" and permit discretionary distributions without causing these amounts to be subject to estate tax at the death of the surviving spouse. As mentioned earlier, it seems appropriate to describe the sprinkling of income and principal between the spouse and children (if there are any) as "having your cake and eating it too."

Death of Surviving SpouseIn most Trusts, at the death of the surviving spouse, there is a need to make final distributions to children and terminate the Trust. For this purpose, there is usually terminology about division of the Trust assets into shares. This system often provides for one share for each child of the Grantor or one share for each child who may have died before the surviving spouse but has issue (grandchildren) still alive. "Issue" of a child means grandchildren of the Grantor, real or adopted. If a child dies before the second spouse dies and leaves no issue (grandchildren), then no share is allocated to that child's family, and the share of that deceased child goes "back in the pot" and is distributed to others.

The provisions relating to distributions to children and grandchildren have to be somewhat lengthy because there are many contingencies to consider. The Trust has to be designed to cover both the immediate death of the Grantor, the subsequent death of the surviving spouse, distribution to the remaining beneficiaries, and the possible continuation of the Trust until minor children or grandchildren have attained a designated age.

If your Trust has provisions for a Sub-trust for grandchildren, then those assets will be kept in the Trust (controlled by the Successor Trustees) until the youngest grandchild of a family reaches a certain age. The objective here is to keep that Sub-trust available for the grandchildren of the family until the youngest grandchild has obtained the designated age of maturity.

During the time the Trust remains in existence, asset distributions are subject to the "guidelines" described for Family Trust use. These guidelines permit distributions for schooling, business development, acquisition of a home, financial emergencies, or any other purpose that the Successor Trustees deem appropriate. Usually expenditures for schooling and medical needs do not reduce the Beneficiary's ultimate proportionate share. Other expenditures for the purchase of a home or business will reduce the share that is eventually distributed to a Beneficiary.

Article VII: Administrative ProvisionsMinors

These provisions permit distributions to the guardians of minor children or grandchildren. For example, the surviving spouse of a deceased child may receive distributions for the benefit of grandchildren without the need for court supervision.

The Rule against PerpetuitiesThis provision is inserted for technical reasons. There is an old English legal concept, now embodied in statutes in most states, that limit how long trusts can last. This rule generally holds that Trusts cannot last for longer than "life or lives in being plus twenty-one years." To be on the safe side, this provision is added to avoid the remote chance that the rule against perpetuities would be violated, thus possibly invalidating or prematurely terminating the Trust.

Spendthrift ProvisionsThis provision is designed to thwart the unlikely possibility of a Beneficiary's selling his or her inheritance. While technically an heir could sell still an inheritance, under this provision the purchaser would not be able to collect anything from the Trustees.

Adopted ChildrenThis Trust provision states that adopted children are to be treated the same as naturally born children. Usually, the Grantor would not want to disinherit a child inadvertently simply because the child was adopted. Sometimes, however, the Grantor may specifically wish to do so.

Small Trust TerminationIf the value of the Trust, or some part of it (a Sub-Trust), falls below $30,000, the Trust can be terminated. The reason for such a provision is that there is no need to keep the Trust in existence if the amount is small and the cost of administration becomes unreasonable.

TaxesThis provision is inserted in the Trust in order that the Trustees can make distributions to the estate of the decedent or pay the estate taxes, if any. Technically, the Trust is not subject to estate tax, but the estate is. If the estate is large enough to incur an estate tax and there are no other assets in the probate estate, it may be necessary to distribute money to the estate for the payment of taxes.

Article VIII: Trustee's PowersAs mentioned earlier, Trusts have to be designed to last for a long time. They also have to be designed to allow for the possibility that corporate Trustees (banks or trust companies) may replace family members who may decline to serve as Successor Trustees. Or, more unfortunately, a Successor Trustees designated in the Trust may be incapacitated or deceased. Therefore, it is necessary to have a rather extensive recitation of Trustees' powers. Rather than describe each paragraph and specific power of the Trustees here, it probably would be easier to state that the objective of these provisions is to allow the Trustee and the Successor Trustees, whoever they may be, to do anything that the Grantor could have done.

At the very end of the "Trustee's Powers," are provisions concerning which state laws will apply. In most Trusts prepared in Virginia, of course, it would be Virginia law.

SignaturesFinally, there is a signature page. The Grantor signs twice, once as Grantor, once as Trustee. This follows because, as indicated earlier, during the life of the Grantor, the Grantor plays all three roles -- Grantor, Trustee, and Beneficiary.

Finally, there is the notarization, Schedule A, and Schedule B. Schedule A is a list of some of the assets contributed to the Trust and Schedule B is a list of life insurance policies, if any.

It is hoped that this Plain English explanation of your Trust has made its purposes and terminology easier to understand.

Pour-over WillThe following sections refer to, and give brief explanations of the purpose and function of, the major parts of a so-called "Pour-over Will."

The term "Pour-over Will" is not used anywhere in the Will document but, nonetheless, this is a "Pour-over Will." This means that any asset not put into the Trust during the Grantor's life "pours-over" (goes) into the Trust at the death of the Grantor as part of the "Residue" of the Grantor's estate. This short Pour-over type of Will is designed to take care of the distribution of personal property, primarily.

There are several reasons why a Will is necessary, even if you have a Trust. The principal one is that sometimes, though not often, people will buy assets such as a condominium in Florida and forget to title it in the name of the Trust. In that case, the wording of the Deed controls. In most cases, if there is a husband and wife, the property will be owned in some form of joint tenancy so that it automatically passes to the surviving spouse outside of the Trust and, of course, not subject to the Will. When the second spouse dies, the real estate will get into the Trust through the Pour-over provisions of the surviving spouse's Will.

Personal RepresentativePersonal Representatives are often the same as the Trustees of your Trust, although they do not have to be. Their obligation is to administer (collect and distribute) the assets of the estate of the decedent and to begin and terminate the probate proceeding, if probate is required. Note that in some situations where there is a Pour-over Will and all (or most) of the assets have been contributed to the Trust during the life of the Grantor, it is not necessary to have any Probate or the Probate might be limited to only those assets which have not been put in the Trust.

Payment of the Last DebtsThe purpose of this Section, as the title indicates, is simply to state that all the debts of the decedent are to be paid.

Personal Representative's PowersThese powers are a stripped-down version of the Trustees' powers in the Trust. The idea here is to allow the Personal Representatives to take care of anything which could have been handled by the decedent.

GuardiansGuardians are the people who take physical control of, and handle the financial affairs of, any minor children. If you have no minor children, then there will be no provisions for Guardians in your Will. For those who have minor children, there will be provisions designating who should be the Guardian of the minor children. Remember that grandparents cannot designate Guardians for grandchildren. That is up to the grandchildren's parents.

Simultaneous DeathAs with the similar provision in the Trust, there are provisions in the Will handling simultaneous death of both spouses, for example, as a result of an airplane or car accident. If there is a simultaneous death, then this provisions states which spouse is presumed to have survived.

Tangible Personal PropertyIn many estate-planning situations with a Trust, the tangible personal property distribution is the primary function of the Pour-over Will. Usually, tangible personal property such as jewelry, clothing, and household furniture are not put into a Revocable Living Trust. The Will usually provides that personal items will be distributed pursuant to two common mechanisms. The most common method is to state that the surviving spouse, if there is one, gets all personal property. If there is no surviving spouse, the personal property is divided equally among surviving children. The other (second) mechanism is to make distributions according to written instructions left by the decedent or a spouse.

Residue of EstateThe residue of the estate is, in effect, the "Pour-over" provision. As noted earlier, the term "Pour-over" is not used in the Will, but that is the effect of the residue provision. After probate, any assets which are not tangible personal property will pour-over into the Revocable Living Trust as a result of the "Pour-over" provision.

Self-proving PageAfter the signature, there is a separate page called the "Self-Proving Page." The reason for the self-proving page is to avoid the necessity for the witnesses having to appear in Court to verify the signature of the Creator of the Will, after the Creator's death.

ConclusionPlease remember that this Plain English version of the Revocable Living Trust and Will is designed to provide an explanation which is easy for you to understand. It is not a legal document and does not replace the technical language of the Trust and Will. If, after reading the plain English version and the more technical documents, you still have questions, please contact me.

Published by the law firm of Newland & Associates, P.L.C. For a full range of business law and tax-related services, call (703) 330-0000. You may also e-mail us at info@tax-business.com, or visit our web site at http://www.tax-business.com."

I hope you find the above posting informative.